Welcome back to PBT!

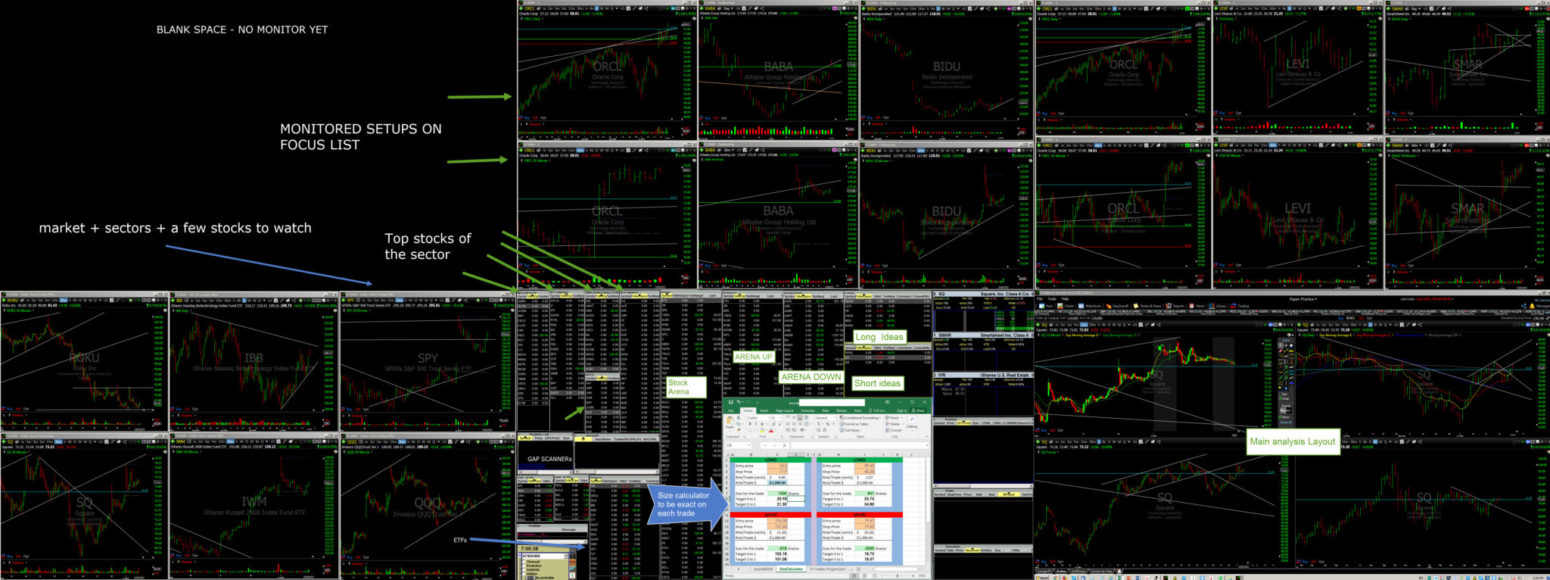

For this post Id like to share my setup so you can better understand the decision making process of what I am doing and how trading decisions are delivered.

Tech

Core i7 – 16GB Ram – Two Video Cards – Five monitors 24”. Will likely add another 3 screens but dont have much room for the mount arm so will postpone this decision. Overall decent trading decisions could be generated and executed using only 3 screens, that is the best solution for beginners.

Platform

Takion – one of the fastest, reliable and advanced for prop-trading. At the beginning its rough and complicated but once you get used to it, it becomes the best trading software you will ever experience. To get a demo, please write me an email at trader521 @ playbooktrading.com.

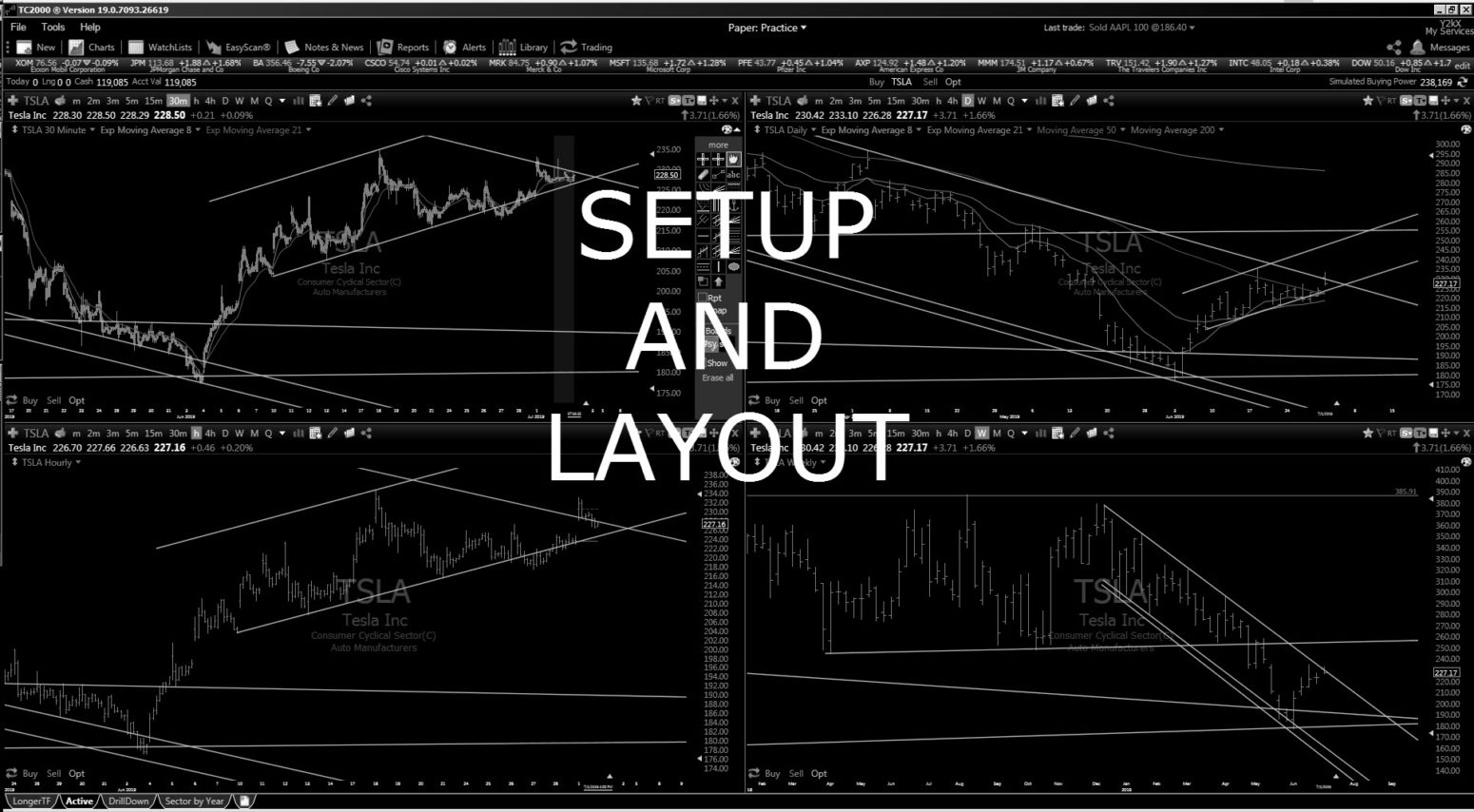

Charting

TC2000 – best value for money and its direct linkable to Takion so its very easy to use.

Overall setup

The preparation for trading has the following process: (1.5hrs before market open).

- Check world markets via – https://money.cnn.com/data/world_markets/europe/ and news via https://www.investing.com/economic-calendar/

- Check Daily and H1 Futures via tradingview SPY (es1!); QQQ (nq1!); Gold (gc1!); Crude Oil (cl1!).

- Check ETFs and Sectors for setups.

- Search for Interesting Earnings via https://briefing.com/investor/calendars/earnings/ or https://estimize.com/calendar

- Search for interesting Gaps that might trigger the setup.

- Analyze Stock Arena and Sector Stocks considering sector ETFs and specific ideas on Daily chart.

- List trade ideas for Long and Short on daily Setup List.

- Wait for Market/Sector/Stock to confirm your setup.

- Trigger the trade with calculated risk.

I do follow a very clear playbook and search for specific setups on daily and intra-day. We will cover the playbook and trading business plan in the future posts.

A lot of traders including myself have a struggle in exiting the position. After applying a more mathematical approach I decided to use Reward to Risk Ratios combined with tier system for exits. Once I have a trade trigger, I will exit gradually in 3 tiers on reaching 4 to 1, 5 to 1 and the rest I will trail by pivots on the triggered time frame. In my experience that will give a better exit average than just hit and run exits. Also this subtracts the emotions out of the equation so once the trade is on, I will just set the limit orders at specific levels according to my calculations.

Sometimes when I do have more time (more than 10 seconds) to take the trade decision I do use the trade calculator that is in the screenshot, that helps get a more exact number of shares loaded in the position to keep up with the math. If you need one of these, let me know and we will email it to you. It is adjusted for 10% of the size in case the price already moved a few cents in the direction of the trade. All you need to do is to setup the risk per trade, that should be a % of your equity (suggested 0.5-1.5%).

That is it for now. Feel free to ping me questions via Twitter or Email posted in this article.

Wish you a great trading session!

— @Trader_521 —