PBT Nation,

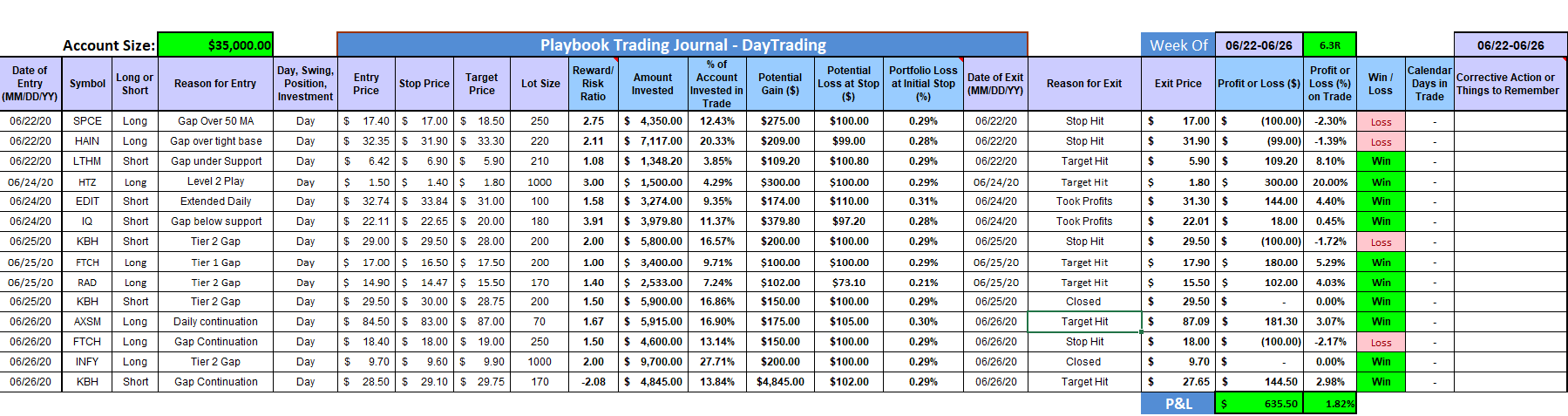

Nice day in the room and for the traders on our alert service. We were 2/3 today with $KBH and $AXSM hitting targets and taking a stop on $FTCH. $INFY was breakeven trade.

We had a nice week and to be exact we are up 6.3R. That keeps our 20Rs streak alive since April. We are on a nice streak. Those of you who joined this week also had a nice week trading with us. Not bad for about an hour a day and sometimes more… J

Weekly Stats: 2% Account Growth

Total Trades – 14

Winners – 10

Losers – 4

Winning % – 60%

Avg winner – 1.5R

Avg loser – 1R